26 Jan 2024

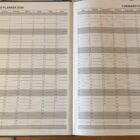

I forgot who it was who said that he wasn’t afraid of flying but of landing. The same philosophy may be applied to borrowing. Borrowing is rather like flying – rewarding, useful and even exhilarating. The scary part is landing the debt and returning it to its hangar. It is worth asking why the US seems uniquely able to borrow with impunity compared to other countries which feature at various stops on the slope downwards to habitual insolvency. I would argue that the three main impediments to foreign investment anywhere are distrust of a government, distrust of its currency and, recently, distrust of the reliability of energy supply. There is one policy that Presidents Trump and Biden appear to share – that if you want to sell in America you need to manufacture in America: and according to UN investment data, the rest of the world is happy to fall in line. Despite apparently going along with the COP religious movement, Biden’s government has been careful to continue America’s pursuit of cheap and independent energy and to be a willing exporter of LNG to the world. In 2022 the US became the leading exporter of LNG and, to the horror of the lobbying organisation Covering Climate Now, a “massive expansion” of export terminals is proposed. “Taken together, if all US projects in the permitting pipeline are approved, they could lead to 3.9 billion tons of greenhouse gas emissions annually, which is larger than the entire annual emissions of the European Union,” wrote a group of scientists in an open letter to Biden in December urging the president to halt the expansion. . Source: coveringclimatenow.org STOP PRESS : President Biden has just “paused” new export licences. Lobbying works, sometimes. Financing public spending by borrowing feels irresponsible. Politicians rarely dare to advocate it. Instead, they do it stealthily. In the US the Biden administration launched the comically named Inflation Reduction Act to lend a sense of responsible purpose to its continuing accumulation of a debt pile now standing at $34 trillion (it was $10 trillion in 2000). Before we believers in prudent finance throw up our hands in horror we must be quite clear about why...